_

_

Topic outline

-

Processing a New Employee

-

1. The Employee Paystub

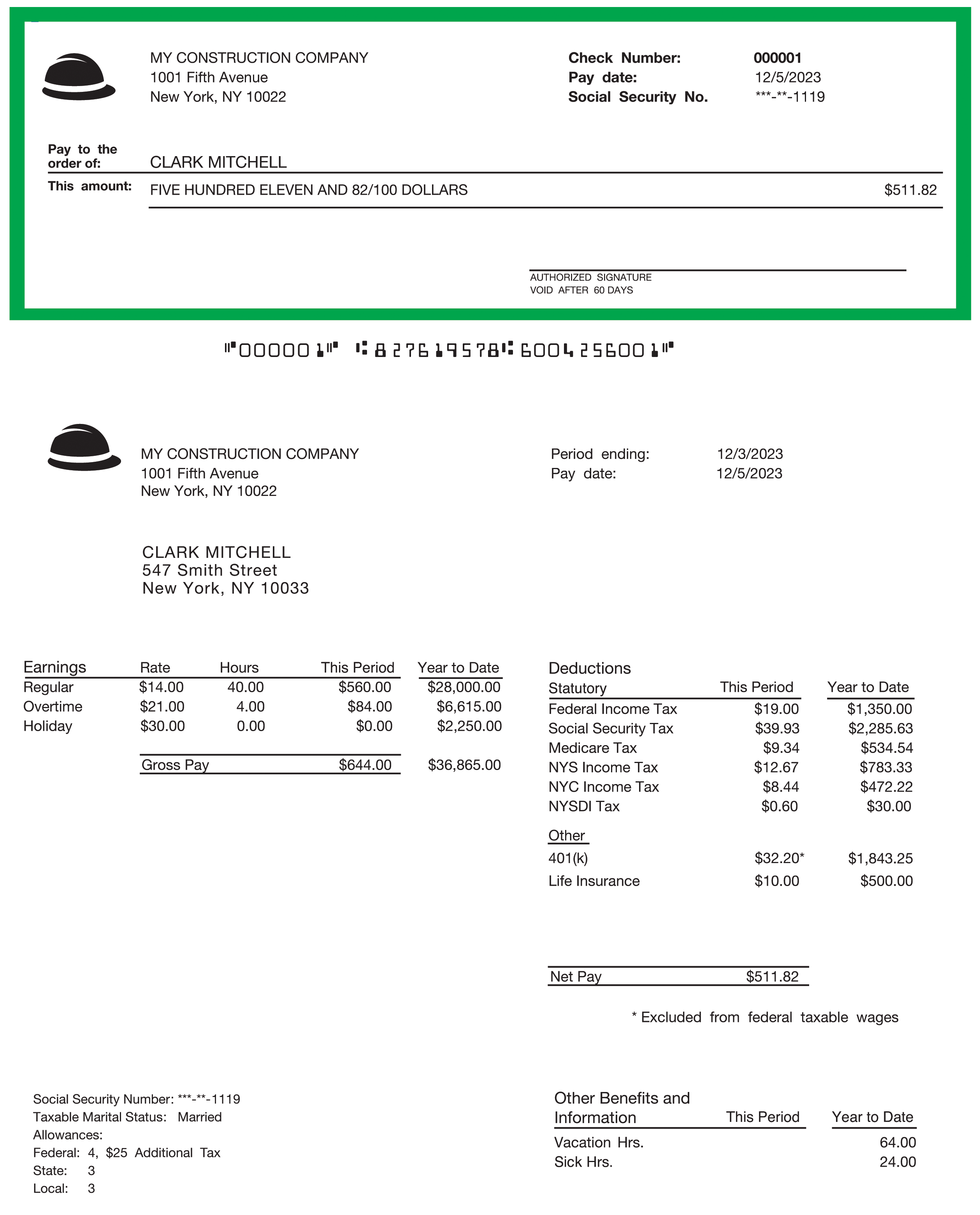

If you have ever received a paycheck, you know that the attached paystub lists a variety of amounts

that are not included in your check. Although you’ve earned these amounts, they are withheld from

your check, each for a different reason. In addition to the withholdings, other pertinent payroll information is also found on the paystub.

Aside from standard employee information such as name and address, the paystub also indicates the

employee’s marital status and the number of withholding allowances claimed. This information is used

to determine the amount of state and federal income tax withholding that is subtracted from gross pay

(total amount earned by the employee). Once these and other deductions are subtracted from gross pay,

the result is net pay (amount actually paid to the employee). As shown in the image, the calculated net

pay on the paystub equals the amount of the employee’s check.

Don’t worry if you feel unsure about some of these elements at this stage. You will examine each in

further detail in the upcoming chapters.Ask Yourself 1-1: Both the employee paycheck and associated paystub display net pay

for the period. True or false -

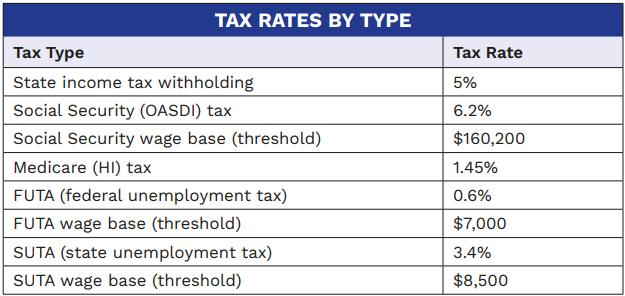

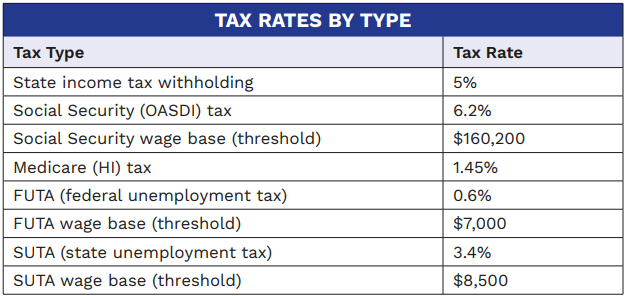

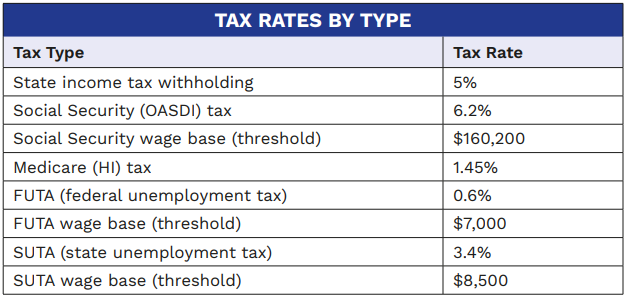

1.1. Summary of Tax Rates

Before moving forward with our examination of the various elements of the paystub, let’s identify the

assumptions made within each chapter. This course uses consistent tax rates, so refer to this summary

table as needed

The state income tax withholding amount varies for each employee based on his/her state, marital

status, and number of exemptions. An examination of each of these rates is beyond the scope of this

course, so we’ll use one consistent rate of 5%.

The Social Security and Medicare tax rates listed, along with the Social Security wage base (over which

Social Security tax is not levied) of $160,200, are consistent with rates in effect for 2023. The federal

unemployment tax (FUTA) rate for 2023 is 6%; however, it may be reduced by a maximum of 5.4%,

which employers are permitted to deduct for paying state unemployment taxes. In most cases we

will use 0.6% (6%–5.4%) as the FUTA tax rate, along with a FUTA wage base of $7,000. The state

unemployment tax (SUTA) rate, which varies from state to state, is assumed to be 3.4%, while the

SUTA wage base (which also varies) is assumed to be $8,500. -

1.2. Case in Point 1-1 Examine the Paystub

Throughout this course, the Case in Point sections provide examples that illustrate the concepts just

introduced. Review these sections to confirm your understanding of the topic before moving to the next

sectionIn these examples, we will examine a number of paystub elements:

- What is the difference between the period ending date and the pay date?

The period ending date represents the final day for which the employee is being paid in the current

paycheck. The pay date is the date on which the actual check is written. - Why are more allowances claimed for federal taxes (four) than for state and local (three)?

This can be due to a number of reasons, but the most likely is that an employee can claim a federal

allowance for him/herself but cannot do so in New York State (where this individual is employed)

for state and local taxes. We will examine allowances further in the W-4 Form section later in this

chapter. - Why are there three different earnings categories on the paystub?

Employers offer different pay rates for different types of hours worked. For example, employees

typically earn 1.5 times more pay for overtime hours than for regular hours. Therefore, hours worked

are broken down by type so the correct pay rate may be applied to each. - Is every displayed deduction withheld from all employee paychecks?

No. Certain deductions, such as federal income tax and Medicare tax, are mandatory deductions

(they must be withheld from all paychecks), while others such as 401(k) and life insurance are

voluntary deductions (the employee can elect to have them withheld). We will examine these

deductions in detail in Chapter 3

- What is the difference between the period ending date and the pay date?

-

2. The Fair Labor Standards Act

Before the paystub elements are calculated and the paycheck is distributed, an employer must ensure compliance with the Fair Labor Standards Act (FLSA). The FLSA dictates a variety of regulations that the majority of employers must follow. The act, originally passed into law in 1938, has been

amended many times. Among its most influential provisions are the establishment of a federal minimum wage, the mandating of 1.5 times regular pay (time and a half) for overtime hours, and the restriction of child labor. -

2.1. The Federal Minimum Wage

To comply with the FLSA, employers must be aware of the federal minimum wage. As of July 24, 2009,the United States Congress increased the federal minimum wage rate to $7.25. Individual states have also passed their own minimum wage laws. When these state‑enacted rates conflict with the federal rate of $7.25, the higher wage rate takes precedence. Recent historical federal wage rates are as follows:

Exceptions to the Federal Minimum Wage

There are several exceptions to the current federal minimum wage rate. One is for workers with disabilities, who may be paid a lower minimum wage. This wage is a percentage of the current prevailing wage

rate for a comparable position and is based on the productivity level of the employee with the disability.Full-time students working for specific employers (colleges and universities, agriculture, and retail or

service stores) may be paid 85% of the current minimum wage rate and are limited to a maximum of 8 hours/day and 20 hours/week while school is in session.

Young workers (under 20 years old) may be paid $4.25/hour for the first 90 days of employment as long as they do not replace another employee. The pay reverts to the federal minimum after 90 days or after

the employee turns 20, whichever comes first.

Tipped employees may be paid $2.13/hour as long as their tips, when added to this amount, equal or exceed the federal minimum wage. These employees must retain all their tips and regularly receive at

least $30 in tips per month. Any deficit (below the federal minimum wage rate) must be made up by the employer. Certain states provide greater benefits to tipped employees.

Student learners enrolled in a vocational school may be paid 75% of the federal minimum wage as long as they remain in the educational program while employed. Employers must obtain an authorizing

certificate from the U.S. Department of Labor to pay these reduced wagesAsk Yourself 1-2: Which group is eligible for an exception to the federal minimum wage?

- Hospital employees

- Workers with disabilities

- School employees

- Local government employees

Who Must Pay the Federal Minimum Wage?

The federal minimum wage applies to employees of all of the following:

- Businesses with gross revenues of at least $500,000

- Federal, state, or local government agencies

- Hospitals

- Schools

-

2.2. Calculating Overtime Wages

Per the FLSA, employees must be paid at least 1.5 times regular wages (time and a half) for all hours worked beyond the first 40 in any given workweek. Similar to the federal minimum wage, certain employees are exempted from this overtime-wage provision, including executive, administrative, and

professional employees.Warning! While the term overtime is often used to refer to a variety of working hours (such as hours worked on holidays, weekends, or evenings), for the FLSA, the term is narrowly defined as those hours worked beyond the first 40 during a single workweek. Employers are legally required to

follow the FLSA definition. -

2.3. Child Labor Restrictions

The FLSA dictates the type of work that may be performed by children of various ages. Children younger than 14 years of age may perform only specific activities, such as performing arts, newspaper delivery,

babysitting, and working for their parents’ sole proprietorships (certain business types are prohibited).

Children aged 14 and 15 may work in a variety of jobs outside of manufacturing and mining, but they are subject to extensive hour limitations. They may work for only three hours on a school day, 18 hours

in a school week, eight hours on a nonschool day, and 40 hours in a nonschool week. They may work only between 7:00 a.m. and 7:00 p.m. (or 9:00 p.m. between June 1 and Labor Day). Certain children may

take advantage of other special programs with more relaxed requirements.

Children aged 16 and 17 may work an unlimited number of hours.Warning! Under no circumstances may a child 17 years of age or younger work in a job classified as hazardous, including coal mining, explosives manufacturing, and roofing.

Children employed in agricultural jobs are subject to less stringent requirements, and children employed by their parents on a farm may perform any nonhazardous job duties.

-

2.4. Case in Point 1-2 Interpret the Fair Labor Standards Act

In these examples, we’ll review four independent employment circumstances and determine whether each employer complies with the Fair Labor Standards Act:

- Robert is a tax advisor for a regional accounting firm in Macon, GA. During one long evening at the office, he uses his annual salary to calculate how much he earns on an hourly basis. He discovers he is earning $6.85/hour during the current year. Is Robert’s employer violating the FLSA? No, Robert’s employer is not in violation of the FLSA. White-collar workers (executive,administrative, and professional employees) are exempted from the federal minimum wage requirements. Therefore, regardless of the number of hours Robert works, he is entitled only to his agreed-upon annual salary.

- Maria is 15 years old, and she works each weekend during the school year as a roofer. She works 7 hours each Saturday and 5 hours each Sunday. During nonschool weeks Maria works an additional 8 hours per day, Monday through Wednesday. Is Maria’s employer violating the FLSA? Yes. Although Maria is working fewer than the maximum number of permissible hours, children aged 17 and younger may not work in a variety of hazardous professions, including roofing. Maria’s employer is in violation of the FLSA.

- Kenneth works for a local diner. On a recent Wednesday he worked six hours, was paid $2.13/hour by his employer, and earned $29.46 in tips throughout the day (which he fully retained). In Kenneth’s state, the federal and state minimum wages are identical. Is Kenneth’s employer

violating the FLSA? Yes, Kenneth’s employer is in violation of the FLSA. When employers use the tip credit provision to pay

tipped employees $2.13/hour, they’re responsible for demonstrating that the combination of wages and tips exceeds the hourly federal minimum wage of $7.25. Kenneth earned $29.46 in tips, which

when divided by the six hours he worked, yields $4.91/hour. The sum of hourly wages ($2.13) plus tips ($4.91) is $7.04, which is below the minimum wage of $7.25. It is the employer’s responsibility to pay

Kenneth the difference of $0.21/hour. - Tina is a full-time college student who works in her university’s bookstore. She works six hours/day on Tuesday, Friday, and Saturday each week and is paid $6.20/hour. Is Tina’s employer violating the FLSA? No, Tina’s employer is not in violation of the FLSA. Full-time college students working for certain employers (including universities) may be paid 85% of the federal minimum wage. Tina’s $6.20/hour wage is higher than this 85% threshold.

-

3. Circular E and Form SS-4

Circular E is an Employer’s Tax Guide written and distributed free of cost by the U.S. Internal Revenue Service (IRS). Also referred to as Publication 15, Circular E provides employers with an excellent starting point when hiring employees. Becoming familiar with Circular E helps ensure that employers comply with all elements of the FLSA.

Among the benefits provided in Circular E are a list of due dates for

payroll-related forms, instructions for calculating federal income tax withholding, and a summary of new payroll regulations. In addition,

Publication 15-T, which is a supplement to Circular E, contains tables

used to calculate federal income tax withholding. These tables are

updated on an annual basis.

Ask Yourself 1-3: What is NOT included in Circular E?

- Due dates for payroll-related forms

- Instructions for calculating federal income tax withholding

- A summary of new payroll regulations

- Tables for calculating federal income tax withholding

-

3.1. Employer Identification Number

To report employment taxes or provide employees with tax statements, which are both required if a company hires employees, a company must first obtain an Employer Identification Number (EIN), also known as a Federal Tax Identification Number, by completing Form SS-4 (Application for Employer Identification Number). If a company intends to pay any employees, obtaining an EIN should be one of the first actions taken after it is formed.

-

3.2. EXAMINE THE FORM: SS-4

Completion of Form SS-4 is necessary prior to remitting employee payroll.

-

3.3. EXAMINE THE FORM: SS-4 (continued)

Line 1: Enter the full name of the individual requesting an EIN or the legal name of the business making the request.

Line 2: Complete this line if the request is being made by a business operating under a different name (a Doing Business As, or DBA, name) than is declared on line 1. All sole proprietorships enter the business name here.

Line 3: This line is primarily used by estates and trusts and may be left blank when the form is being completed for the purposes of remitting payroll.

Lines 4a and 4b: Enter the company’s mailing address.

Lines 5a and 5b: Enter the company’s physical address if different from line 4.

Line 6: Enter the county and state of the business’s physical location.

Lines 7a and 7b: Enter the name and Social Security number (SSN) of the responsible person (individual who exerts control over the business).

Lines 8a–8c: Complete these lines only if the business was formed as a limited liability company (LLC).

Line 9a: Check the box that correlates with the type of business making the request.

Line 9b: Complete this section only if you selected a corporation option on line 9a.

Line 10: For payroll purposes, you will typically check either Started new business or Hired employees, depending on the circumstance.Line 11: Enter the starting date or date the business was acquired. If the corporate form was

changed, enter the effective date of the new ownership form.

Line 12: Enter the final month of the company’s fiscal year. While this is commonly December, a company may end its fiscal year during any month.

Line 13: Enter an estimate of the number of each type of listed employee.

Line 14: For all businesses except those with the smallest annual payroll, do not check this box.

When unchecked, a quarterly Form 941 will be required.

Line 15: For a new business, or for an existing business that has now hired employees, enter the

first date on which wages are paid.

Line 16: Check the box that most closely represents the company’s line of business. If checking

Other, include a brief description.

Line 17: Provide a one- or two-sentence synopsis of the business.

Line 18: Check the appropriate box, and if a previous EIN was issued, include it here.

Third Party Designee: Complete this section if you want an outside party (such as an outside accountant) to answer questions regarding the form on the company’s behalf.

Signature Line: Fully complete all components within this section. -

3.4. Case in Point 1-3 Complete Form SS-4

In this example, we’ll complete Form SS-4 for a newly formed company, Wood Furniture Builders,

Inc. It was started on August 21, 2023, as a sole proprietorship by its president, Samuel Williams (SSN 555-55-5555). His phone number is 516-555-5555 and his fax number is 516-555-5556. The company is located at 748 Negra Arroyo Lane, Massapequa, NY 11758 (in Nassau County), where it receives all mail. The company uses the calendar year as its fiscal year and expects to employ five individuals (earning an average of $36,500/year) in the first 24 months of operations. Payroll is to be paid biweekly on Fridays, with the first pay date scheduled for September 1, 2023.

Complete lines 1–7 with basic information. Leave line 3 blank, as it is not applicable for a new business. Also leave lines 5a and 5b blank, as the mailing address and physical address are identical.

Complete lines 8–10 using information provided about the business entity. Select “No” on line 8a, as this company is a sole proprietorship and not a limited liability company (this is why lines 8b and 8c are left blank). Select “Sole Proprietor” on line 9a and enter the company president’s Social Security number. Leave line 9b blank, as this company is not a corporation. Select “Started new business” on line 10 and include the basic business description.

Lines 11–15 relate to the company’s start date, fiscal year, and payroll. Enter the business start date of 8/21/2023 on line 11 and “December” on line 12, as the company follows a calendar year (operations are reported annually from January–December). The company’s five employees

don’t qualify as agricultural or household employees, so enter “5” in the “Other” category on line 13. Employees are projected to earn an average of $36,500 each per year, and therefore the company must file Form 941 quarterly, so do not check the box on line 14. Enter the first pay date of 9/1/2023 on line 15.Lines 16–18 request information about the company’s current and prior operations. Check “Manufacturing” on line 16. Line 17 calls for a more extensive description of the business than was written on line 10. As this is a new business that has not previously applied for an EIN, check “No” on this line.

No, third-party designee is referenced, so leave this section blank. Finally, Samuel Williams completed all information in the final section and has signed the form.

-

4. Hiring an Employee

When a new employee is hired, a number of considerations must be made by both the employee and the employer. These considerations not only provide employers with information required to properly process payroll, but also enable them to comply with applicable federal and state laws.

-

4.1. The Personal Responsibility and Work Opportunity Reconciliation Act of 1996

The Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA) significantly strengthened child support throughout the United States. This was achieved in various ways, including through the mandatory reporting of new employees within 20 days of hire, enabling

better enforcement of child-support laws. Employers can satisfy the provisions of this act by submitting the newly hired employee’s W-4 Form to the state. We’ll examine the W-4 Form in more detail later in this chapter.

Warning! Some states have more stringent requirements than those required in the federal

provisions for PRWORA. -

4.2. Form SS-5

The W-4 Form requires the employee’s Social Security number. Employees

who don’t have a Social Security card can obtain one by completing and

submitting Form SS-5 to their local Social Security office.

Tip! Form SS-5 is also used to obtain a replacement Social Security

card or to correct information in the Social Security record.EXAMINE THE FORM: SS-5

Form SS-5 is completed by any employee who does not have a Social Security number.

EXAMINE THE FORM: SS-5 (continued)

ost lines within Form SS-5 are self-explanatory. Lines that warrant specific mention are the following:

Line 2: Leave this blank if requesting a Social Security card for the first time.

Lines 6 and 7: These lines are optional and may be left blank.

Lines 9b and 10b: Complete these lines when the application is for a minor (individual under the age of 18).

Line 17: If the application is for a minor, their parent or legal guardian may sign on their behalf.When submitting Form SS-5, additional documentation is required to corroborate information about the applicant, such as the applicant’s age, identity, and U.S. citizenship (or immigration

status). While the combination of a U.S. birth certificate and U.S. driver’s license suffices, other documents such as a final adoption decree, U.S. passport, or a current document from the Department of Homeland Security indicating immigration status can corroborate some details. -

4.3. Form W-4

Every employee must complete a W-4 Form (Employee’s Withholding

Allowance Certificate), which provides the employer with information

necessary to calculate federal income tax withholding and applicable state

income tax withholding. Completing the W-4 Form should be one of the

first steps taken by a newly hired employee.The employer retains the W-4 Form in its files. If the employee’s circumstances change, he/she may submit a new W-4 Form.

The employer retains the W-4 Form in its files. If the employee’s circumstances change, he/she may submit a new W-4 Form.

As a result of the Tax Cuts & Jobs Act (TCJA) of 2018, Form W-4 underwent a significant redesign. The new Form W-4 is completed by employees receiving their first paycheck in 2020 or later. Employees who began

working prior to 2020 are not required to complete the revised version of

the form. Since most employers, therefore, will have both versions of Form W-4 on record, it’s important to understand each.The current version of Form W-4 represents both a rearrangement and an expansion of the earlier version. Whereas the 2019 version used a worksheet to incorporate a variety of necessary components, the current version displays these elements directly on the form.

EXAMINE THE FORM: W-4 (CURRENT VERSION)

The lines an employee enters on the W-4 Form are as follows:

Step 1: Enter their personal information, including expected tax return filing status. If this status changes during an individual’s employment, a new W-4 Form is completed and submitted.EXAMINE THE FORM: W-4 (CURRENT VERSION) (continued)

Step 2: This step primarily offers instruction for completing the next two steps and applies to an employee who either works multiple jobs or whose spouse is also employed. To determine the amount of federal income tax withholding, the employee can use an online tax estimator made

available by the Internal Revenue Service (option “a”), complete the Multiple Jobs Worksheet included in the form’s instructions (option “b”), or indicate there are two jobs in total (between the spouses) that pay roughly the same amount (option “c”). While option “a” gives the most accurate data in terms of estimating federal income tax withholding, option “c” is the most straightforward option for those who qualify. The employee completes Steps 3 and 4 for the highest-paying job (this includes jobs worked by a spouse). These steps are left blank for all other jobs.Step 3: For employees who will report less than the income thresholds indicated, this section allows for the inclusion of dependent tax credits into the calculation of federal income tax with holding. Additional tax credits beyond these can be included by adding them to the total determined on line 3. Completing this section involves multiplying the number of qualifying children (top line of this step) and/or the number of other dependents (second line) by the indicated figures on the form to determine a total for the final line.

Step 4: Completing this optional section helps ensure the proper federal income tax withholding is determined. Other income (on which tax is not presently being withheld) can be listed on line 4(a), additional deductions (above the standard deduction) can be listed on line 4(b), and extra withholding (which an employee deems appropriate based on a circumstance not covered by the remainder of the form) can be listed on line 4(c).

Step 5: The employee must sign and date the completed form before it is submitted to the employer.

Employers Only: This line is completed by the employer if the W-4 Form must be submitted by the employer to a governmental agency -

5. Additional Hiring Considerations

Before an individual can become an employee of any company, the employer must confirm that the prospective employee is permitted to work in the United States. The Immigration Reform and Control Act of 1986 outlines these regulations. All employees must complete Form I-9 as part of the verification process.

-

6. General Payroll Topic

Additional considerations must be made prior to, or concurrent with, the hiring of employees. Among these are the acquisition of workers’ compensation insurance and the establishment of an employee earnings record for each employee. Other payroll topics that warrant consideration include the decision to use a payroll services provider, or whether a payroll professional should pursue a specialized payroll certification.